The Federal Reserve announced a 0.25% rate cut yesterday. Yet, we are not seeing much impact.

Here is an update we just received from Todd Parsons, Origin Point Mortgage.

——————-

I just wanted provide a quick update on Interest Rates. Yesterday, the Federal Reserve announced an additional 0.25% rate cut, which was the number expected by the markets, and had little immediate impact on mortgage rates.

The current Federal Funds rate has been reduced to 4.5%, and the average 30 year fixed mortgage rate sits at 6.98% today.

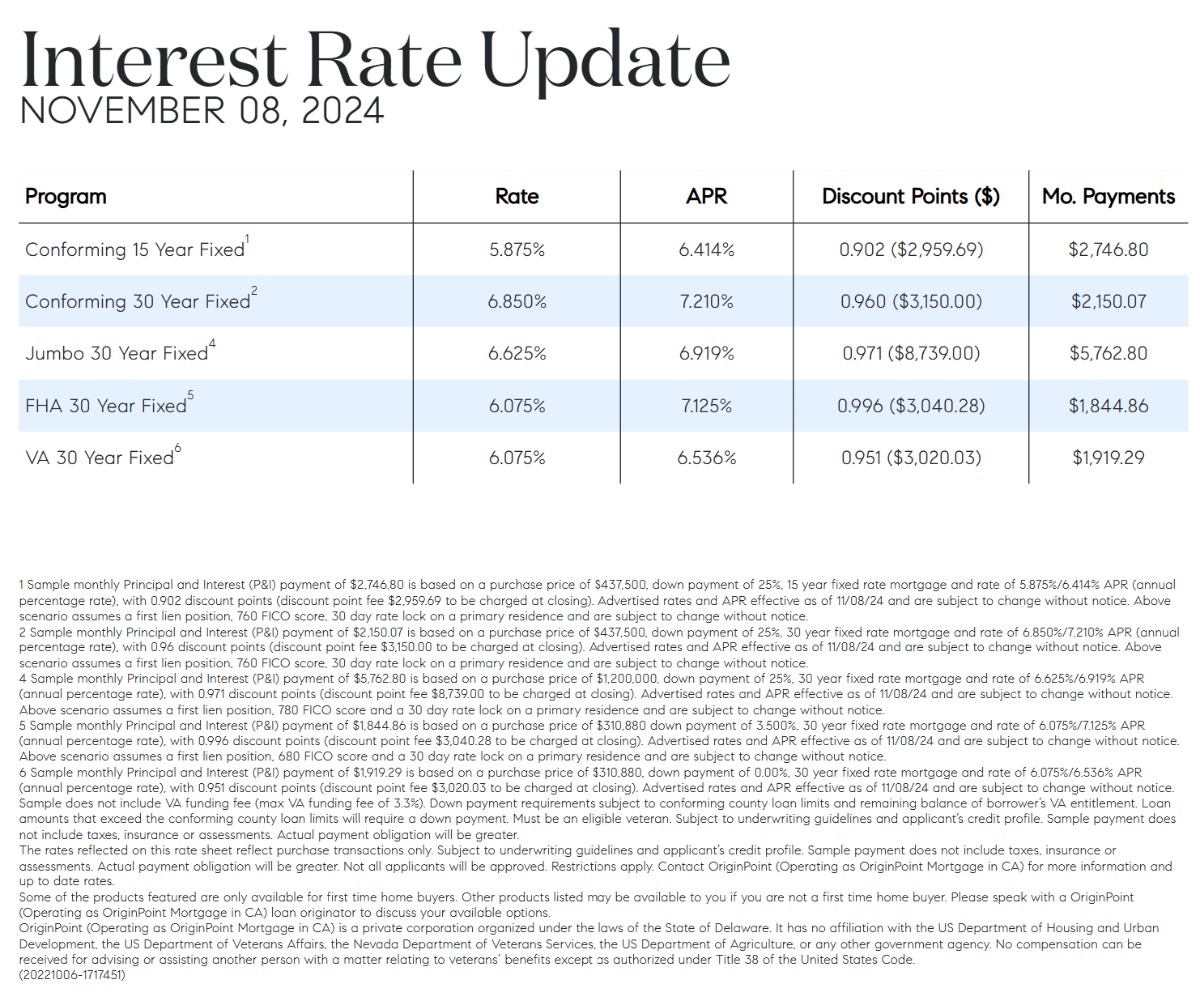

As you can see from the chart below, mortgage rates have been in an upward trend since Mid-September. This has been driven by consistent positive economic data, and markets re-setting expectations for the speed and duration of future rate cuts.

With the Federal Funds rate down to 4.5%, I can’t see mortgage rates moving much higher. However, I’d guess we’ll settle-in to this general range until over the next 30-60 days, as markets digest the election news and re-price expectations for rate cuts in 2025.

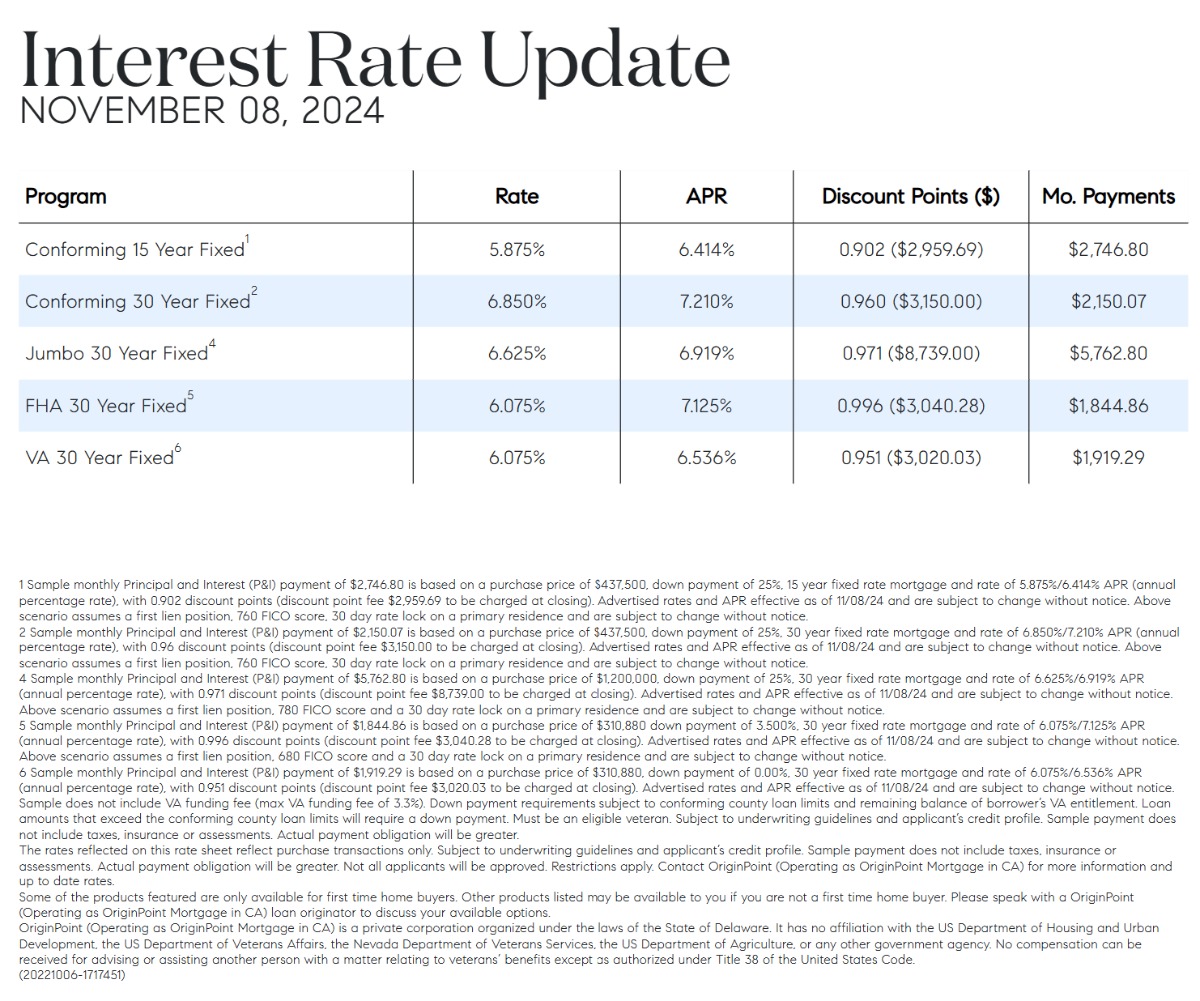

I’ve also provided current OriginPoint rates below. Please don’t hesitate to reach out if you have any questions or requests!

Todd