Each month, we share our data flipbook featuring essential insights, focusing on the west side of the Big Island. If you have any questions or want to discuss market trends in your neighborhood, please feel free to reach out!

September kicked off much like August, with the U.S. stock market experiencing a significant pullback as investors repositioned themselves ahead of key economic data. The major reports to watch this month include the employment report on the 6th, the Consumer Price Index (CPI) on the 11th, and the Federal Open Market Committee (FOMC) policy announcement on the 18th. These will provide critical insights into U.S. inflation and interest rate trends. Many expect the upcoming employment report to show continued wage growth, which could strengthen the case for a modest 0.25% rate cut by the Fed later this month.

In the national real estate market, U.S. home prices rose 4.0% year-over-year in July 2024, reaching a median price of $438,837, with home sales up by 6.3%.

Here in Kona, the median price for homes increased by 10.5%, and condos saw a remarkable 21.7% rise. However, the condo market dynamics are shifting, influenced by ongoing insurance challenges in Hawaii. Keep reading for more details.

Kona Market Update – September 2024

The Kailua-Kona real estate market is experiencing varied dynamics across its single-family home and condominium sectors.

- Single Family Homes: The market remains stable with a median price of $1,299,000, reflecting a 10.5% year-over-year increase. The months of supply are steady at 2.6, indicating a balanced market with stable demand and supply dynamics. Despite a slight decline in pending sales, the days on the market remain unchanged at 21 days, showcasing a consistent sales pace.

- Condominiums: The condo market is experiencing notable shifts. The median price increased again this month to $672,500, marking a year-over-year increase of over 20%. Active listings have climbed to 70% of pre-pandemic levels, indicating a significant change in inventory. For the first time since 2020, the months of supply have surpassed the 5-month threshold, suggesting a transition toward a buyer’s market. Factors like insurance challenges, high interest rates, and rising maintenance fees contribute to affordability concerns, which may explain why median prices continue to rise despite a decrease in sales. Meanwhile, the ultra-luxury segment remains fiercely competitive, with limited inventory and multiple offers.

With the conclusion of the summer tourist season, the market typically slows down from September to November, offering strategic opportunities for both buyers and sellers. This period might be optimal for sellers to prepare listings and for buyers to negotiate more favorable terms.

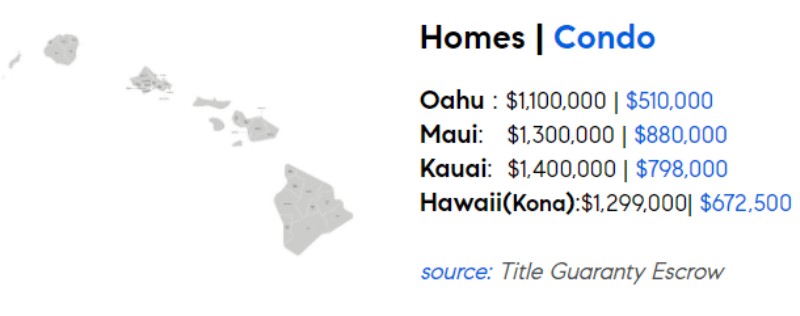

Median Price by Island

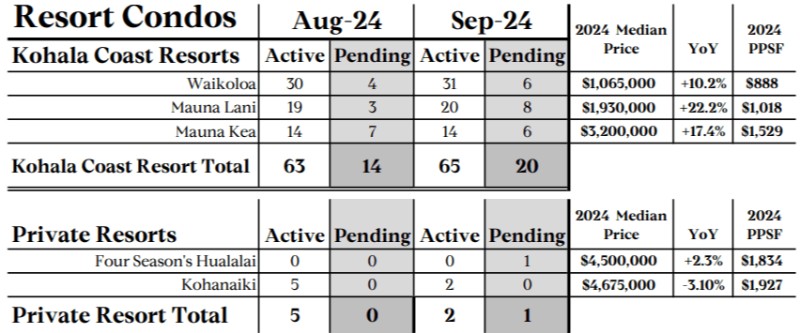

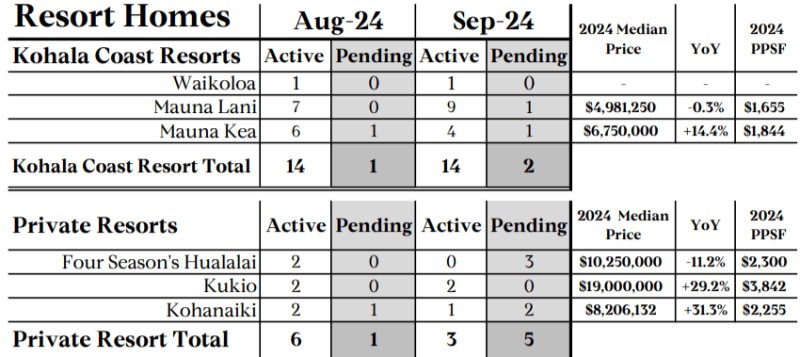

Big Island Resorts

National Real Estate Insights

- Year over year, the July median single-family-home sales price and the median condo/co-op price were up 4.2% and 2.7% respectively: Both declined slightly from all-time highs in June.

- The supply of existing-home listings rose 20% year-over-year to the highest count since autumn 2020, while the number of new-construction single-family homes on the market was the highest since 2008. Price reductions on active listings in July jumped 43% year-over-year.

- Existing-home sales increased 3.5% from June and 4.6% from July 2023 but remained far below long-term norms.

- Approximately 62% of sales went into contract in less than 1 month (vs. 74% in July 2023), 24% sold over list price (vs. 35% last July), and 27% were purchased all-cash (vs. 26%). The median days-on-market to acceptance of offer was 24 days (vs. 20 days last July), and sold listings received an average of 2.7 offers (vs. 3). Distressed-property sales (foreclosures and short sales) remained extremely low at 1% of total sales.

Compass National Real Estate Insights

Hawaii State Median Prices